“May you live in interesting times” is a rough translation of a traditional Chinese proverb that is bearing more meaning today than ever in the history of SaaS.

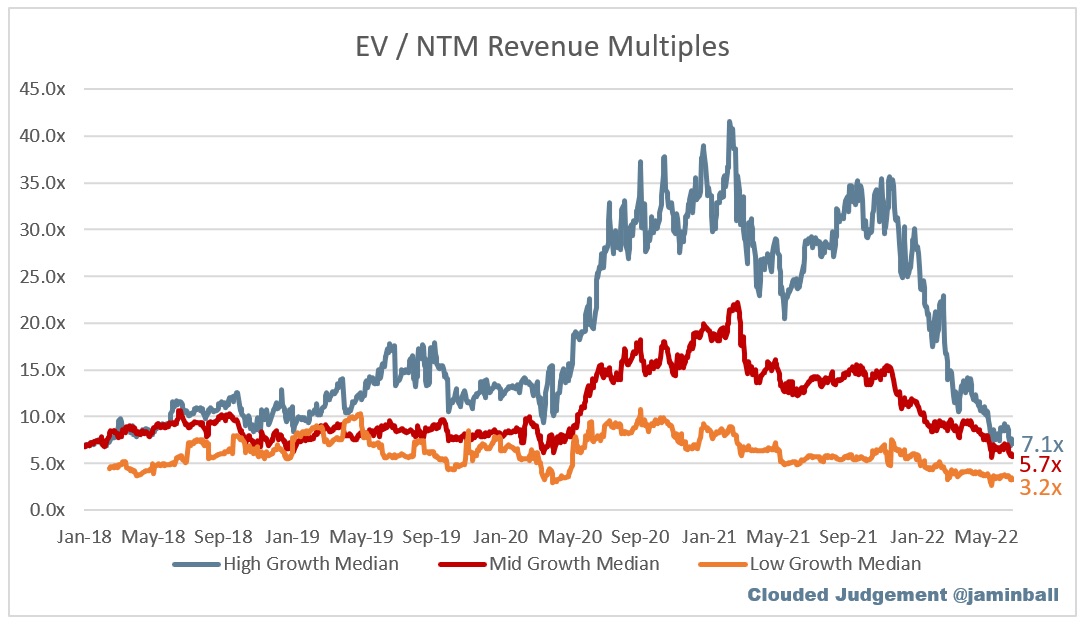

After a brilliant run up to 2022, SaaS valuations got hammered in the public markets lately.

And with rising interest rates and weakening global demand, it seems like choppy waters are here to stay.

It may sound like doom and gloom but periods like this flesh out what is best in our industry.

So let’s talk about what you as a founder or a SaaS operator can do to position yourself for a weaker growth environment.

So Where Are We? And What’s Ahead of Us?

If you tuned into the All-In podcast you would’ve heard a ton of sentiment analysis and commentary from influential VC voices.

“As soon as survival risk’s on the table… you really have to act differently – it’s kinda like the difference between a poker tournament and a cash game… In a poker tournament players are much more conservative – because once you’re out – you’re out… Whereas in a cash game you can just re-buy.”

David Sacks, Craft Ventures

If we pause and think about the term sheets offered in the last 2 years, the valuation run-up was nothing short of impressive.

But things have started to turn. Some investors are even pulling out of term sheets altogether.

Rising inflation, a high-interest rate environment, and the cooling down of the pandemic-driven demand have all hammered SaaS valuations in the past few months.

SaaS startup growth has taken a hit as well as we noted.

And the outlook from here on doesn’t inspire much confidence considering the economy outside of tech has issues too.

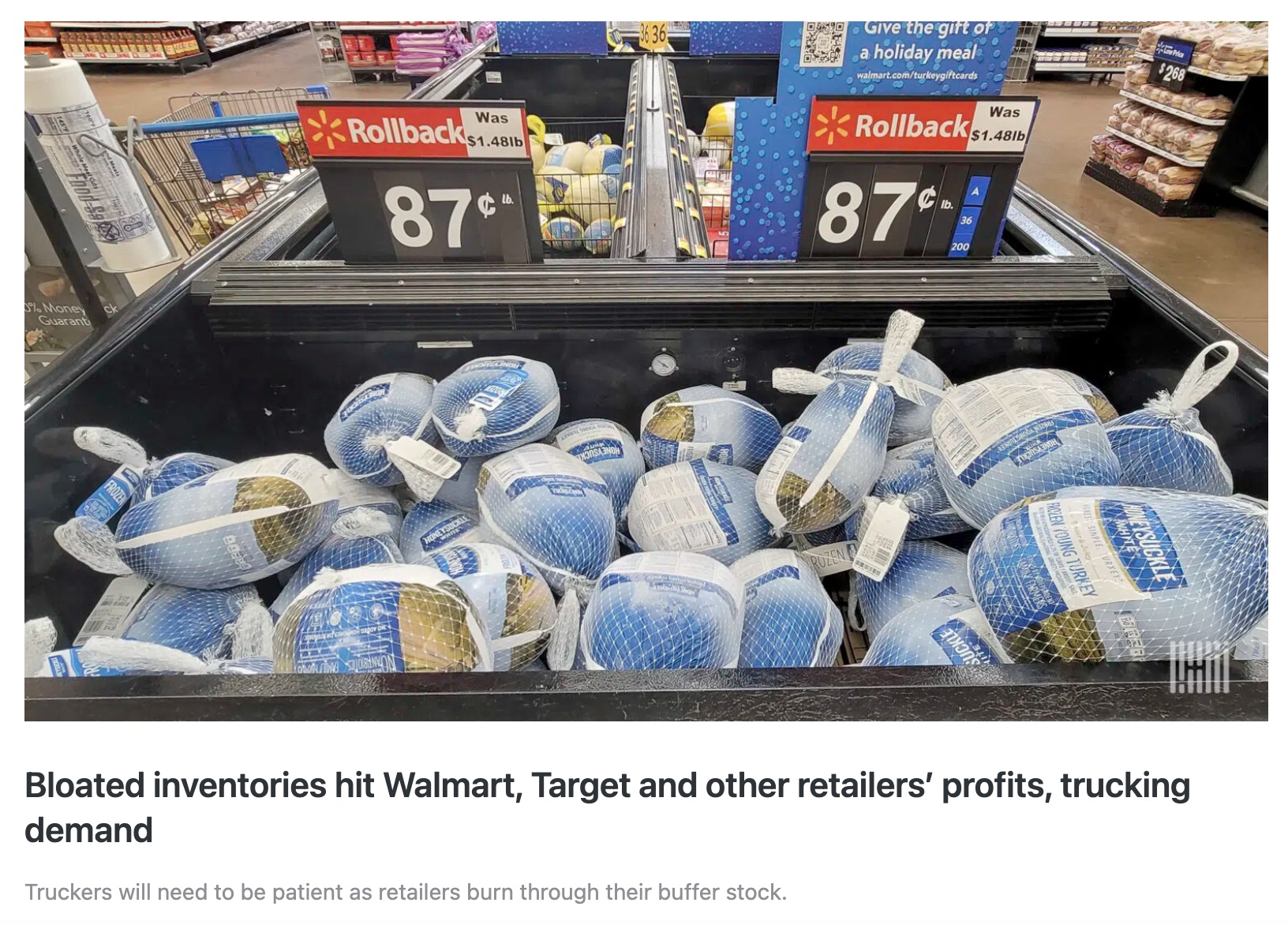

What was last year’s “inventory shortage” is quickly turning to be an “inventory glut” as companies that double-ordered inventory hoping to get more stuff through and satisfy consumer demand suddenly face less robust consumer spending.

In the SaaS world, that means the consumer-facing apps & marketplace SaaS have a tougher time ahead. B2B is in a similar bind — a conservative spending approach and a tougher financing environment will affect SaaS spending as well, meaning that we might see things get worse before they get better.

What Should You Do?

The question on every CFO’s mind will be — what can we rip and replace and what is mission-critical? Here are a few thoughts:

1. You Should Double Down on Your Core Product Offering

This is a perfect time to invest in your user base & core product offering because playing to your strengths will pay off.

So forward-looking PMs and dev teams here should prioritize stickiness of the product more and try to create the conditions where you’re dealing with real value add product features instead of “nice to haves”. In short, the product-market fit needs to be strong to the point where the cost of rip & replace outstrips the savings from cutting the service.

If you think about your DevOps, moving from one cloud infrastructure setup to another is quite a demanding task that requires resources and manpower. Trust us, we did it recently and you can read more about our migration here. You might be hard-pressed by your AWS bill but you’re not going to start replacing the engine to lighten the load mid-flight. Although, you might drop the training wheels pretty fast.

2. Dig Deep Into Your Financials

Given the choppy growth environment, how should you position your financials?

It depends on a few things — your size, burn rate, the time elapsed from the last raise, and the general ability to weather the storm. No one can know how much of your bottom line will be affected as well as what the future financing prospects look like. So a defensive posturing might give you more leeway.

One thing is definitely true — stakeholders will require more information about your KPIs.

You will want to know more about it, too — growth might be skewing towards industries where you achieve better product-market fit, and doubling down on them might be a good idea.

The pace of change will matter more than the headline number and focusing on rate change will help you spot inflection points, and improve your forecasting and overall trend better.

If you’re finding yourselves thinking “I’m not sure if we can 100% trust our metrics” — happy to get you set up with ChartMogul for comparison & data audit.

Book your ChartMogul demo now.

3. Rethink How You Sell Going Forward

The last 2 years of SaaS twitter summed up sales into two simplistic formulas for achieving growth:

PLG & raising prices

While I don’t expect the PLG trend to slow down, the lower cost overhead of “burden-less” no-freemium and bespoke enterprise software might do better here — especially for companies that can leverage the duration of their multi-year contract offerings compared to those relying on shorter-term subscriptions.

Just looking at Netflix and its monthly user decline, as well as market reaction to it, tells the tale of missed expectations and rapidly shifting sentiment. In times like these, emotions are high and churn hurts more emotionally and materially, and after 2 years of upwards price adjustments, we might be seeing some price concessions in exchange for duration and predictability.

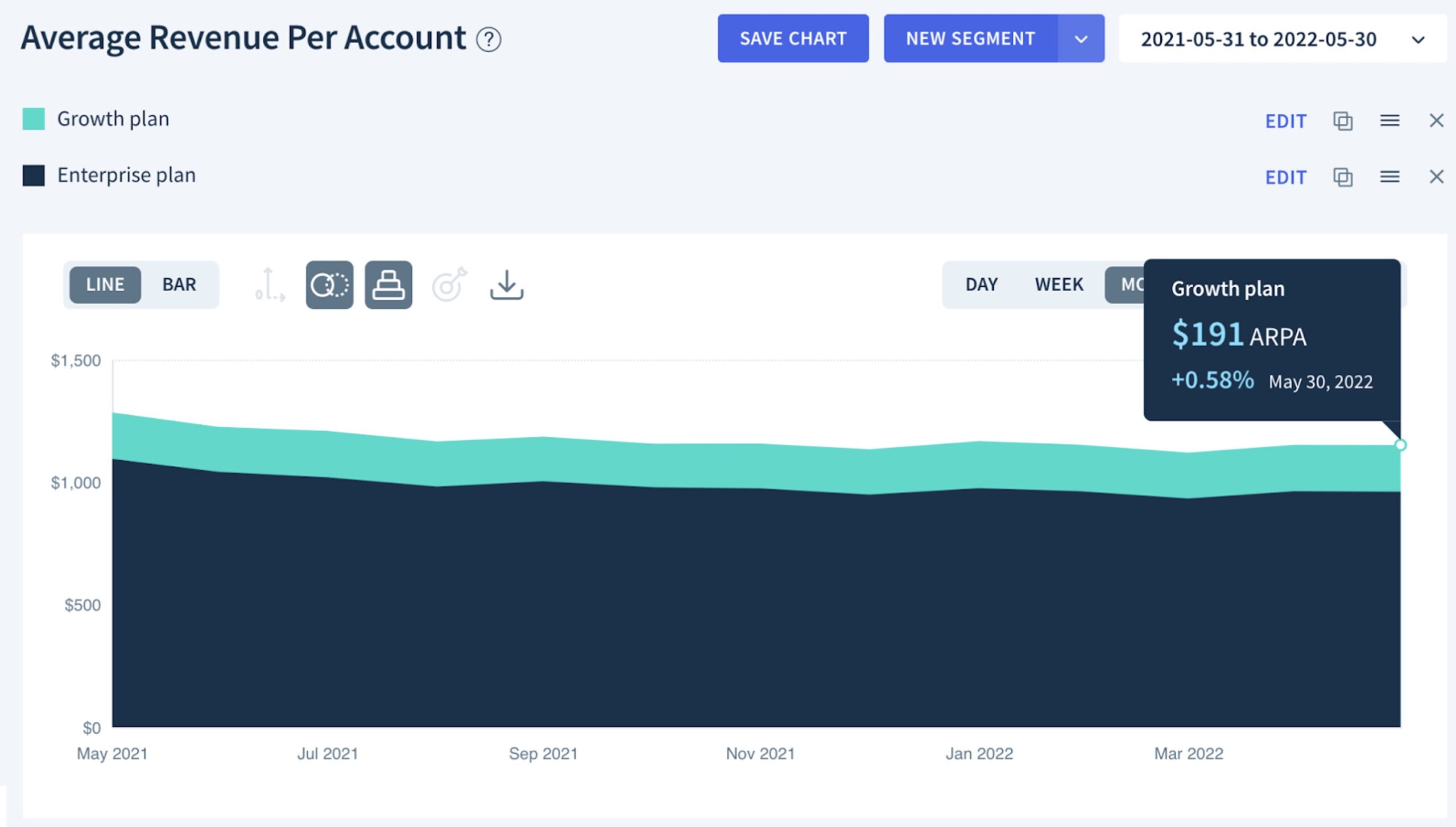

The trick, here again, is not to panic and keep a close eye on your ARPA in all user segments.

Sales teams will be incentivized to sell longer duration and nurture their best deals even more in an effort to keep growing. While we probably won’t see heavy discounting, the best SaaS companies out there will be able to keep their bottom line and expand in their competitors’ customer base but it will require top-notch, responsive, and proactive Customer Service and Sales teams to onboard & retain your customer base.

4. Seek Out Advice

We’ve had eleven straight years of SaaS expansion with one of the best bull markets in tech ever. No one is calling for an end to it but if the times get tough — there are niche communities that help contextualize the situation and let you hear the street talk.

If you’re a salesperson like me, Bravado’s War Room is an online sales forum that recently discussed some of the layoffs in tech people are seeing. The Mogul.io community founded by ChartMogul is a great place to chat with other founders and get some advice from your peers.

Lastly, we’re here to help as well. If you’re our customer, reach out to us if you need some perspective on your metrics. If the choppy SaaS waters are here to stay, that’s usually a good time to be curious, data-driven, and strategize the next steps.

Further Reading

- Yes, SaaS Startup Growth Is Slowing Down by Sid Jain, ChartMogul

- Operating During a Downturn by David Sacks, Craft Ventures

- What Is a Recession & Are We in One Now? by Eric Basmajian, EPB Macro

- Forecasting and Scenario Planning by Ravi Gupta, Pat Grady, Sequoia Capital